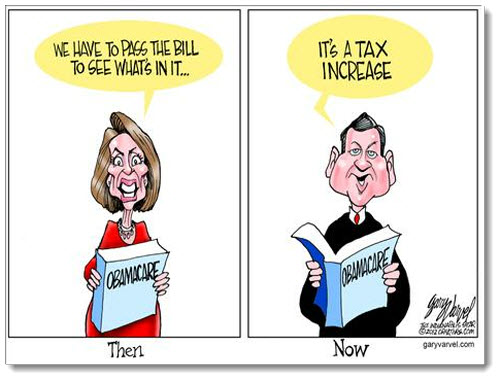

Editor’s Note – Remember when Nancy Pelosi famously said the following about the Obamacare Bill? It was passed without knowing the details but now that its being implemented, even Democrats are crying foul, or is it “fowl”, as in the roosting has begun.

%CODE%

Well now we see the chickens coming home to roost. Eighteen Democrat Senators who voted for the bill now want Harry Reid to delay implementation of a portion of the bill. The portion that taxes medical devices, a major employer and one the few good stories on our trade balance, is now a problem for these Senators.

If they, like all the others who forced this bill down America’s throat actually read the abomination, it would never have passed. Thanks Nancy, now we see what was in it. Many of us screamed this out, yet, its the law of the land now. Dear Senators – you were to clever by half – as usual! Read the letter here (also below) and see the signatures.

The “funny” thing is – it will affect your pet care bill as well – they do use medical devices!

The other funny thing is that even Al Franken signed this letter. Yes, that Al Franken, the one who stole the Senate seat in Minnesota through the felon voting scandal. He was the last vote needed. Had he not become a Senator, we would not be havind this discussion.

Democrats seek delay in one Obamacare tax increase

By Tom Curry, NBC News national affairs writer

Even as President Barack Obama and House Speaker John Boehner struggle to find a way to avoid income tax increases in the New Year on almost all households, a separate set of tax increases which Obama signed into law as part of the 2010 Affordable Care Act (ACA) will begin to affect workers, investors and employers on Jan. 1.

Even if Boehner and Obama reach a deal on the “fiscal cliff,” $24.6 billion in 2013 Obamacare tax increases must take effect on Jan. 1 in order for the carefully designed health care overhaul to function in budget terms as its supporters promised it would: not adding anything to future budget deficits, but, according to an estimate by the Congressional Budget Office (CBO), reducing cumulative deficits by $132 billion between 2010 and 2019.

The Obamacare tax increases which begin on New Year’s Day are:

- A 2.3 percent tax on manufacturers and importers of medical devices.

- A limit on the tax deductibility of medical expenses for people who pay some of their medical costs out of pocket.

- A limit on tax-sheltered health flexible spending accounts.

- An increase in the Medicare payroll tax on single earners making more than $200,000 and married couples making more than $250,000.

The delicate balance of tax increases and spending increases in Obamacare will work only if Congress allows the tax increases to take effect, so they can offset the cost of substantial new insurance subsidies and other Obamacare outlays.

But some Senate Democrats are trying to delay at least for one year the tax on medical device manufacturers, which will raise nearly $2 billion in new revenue in 2013 and $20 billion over the next seven years.

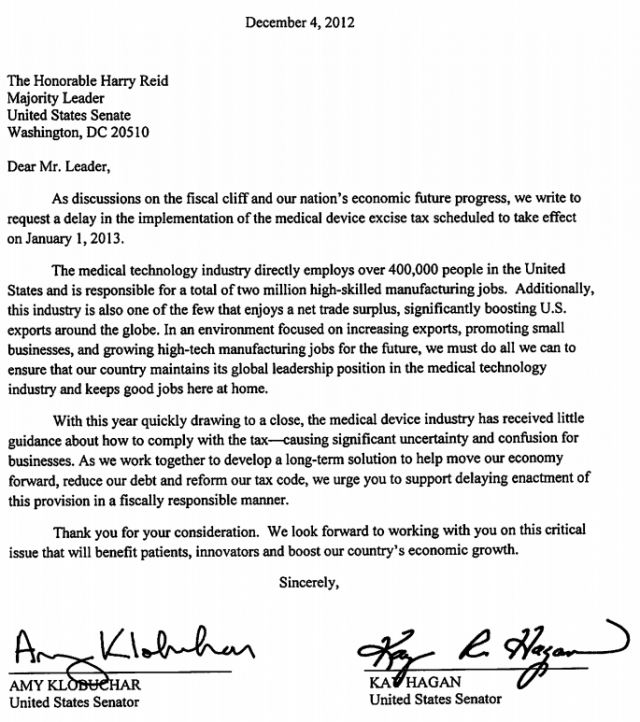

In a letter Monday, Sen. Amy Klobuchar, D-Minn., Sen. Kay Hagan, D-N.C. and others asked Senate Majority Leader Harry Reid to work to postpone the medical device tax.

Both Klobuchar and Hagan voted for the ACA and Minnesota is home to one of the biggest medical device makers, Medtronic.

A delay in the tax could be part of the year-end fiscal package. “My guess that it would be part of bigger deal before the end of the year,” Klobuchar told NBC News Tuesday.

The Democrats calling for delay are emphasizing the need for medical device industry jobs.

“We’re focused on this because there’s a number of small start-up companies (which would be affected by the tax),” Klobuchar said. The medical device tax was set to raise $40 billion over 10 years “and then reduced in half without real negotiation about how it would affect jobs and the industry. So this one, above all to me, cries out for a change.”

She said the IRS regulation spelling out exactly how the tax will be collected and enforced was issued last week toward the end of the year “without giving them (the medical device firms) time to figure out how to comply. So we’re simply at this point looking for a delay and if we can make some changes to reduce or repeal it, that would be the goal,” Klobuchar said.

Hagan said, “There’s so much innovation in this field right now and they do create so many good jobs in our country that we have the risk of losing these jobs to Ireland and to many other countries. And that’s the problem,” said Hagan, who is up for re-election in 2014.

When she added that the tax would have “an adverse effect on jobs throughout our country,” she was asked whether the tax – after the one-year delay that she and Klobuchar are requesting – would have an equally adverse effect on jobs in 2014. “We can certainly look at that over time,” she said.

J.C. Scott, senior executive vice president of government affairs for the Advanced Medical Technology Association said, “We appreciate Sen. Klobuchar and Sen. Hagan’s leadership on this issue and also appreciate the broad bipartisan support for preventing the implementation of the device tax which is slated to go into effect Jan. 1. Delay of the tax is an important step, but Congress must fully address the device tax as it works to develop a long-term solution to help our economy move forward, reduce our debt and reform our tax code.”

The industry group said that the U.S. medical technology industry supports nearly 2 million jobs and that nearly 43,000 jobs might be at risk if the tax takes effect.

If this call for delay and “reduce or repeal” reflects a weakening of support for Obamacare’s revenue raisers among Democrats, that could be worrisome for both deficit reduction and cost reduction since both of those were goals of Obama’s health care overhaul.

Even as they voted for the health care overhaul in 2010, some congressional Democrats said they thought that another one of the tax increases in the law, the tax on high-cost “Cadillac” health insurance plans would never fully take effect because Congress would water it down or repeal it before 2018 when it is set to effect.

If Democrats delay, reduce or repeal the medical device tax, then the ACA will not cut costs as much as its proponents and the CBO predicted it would.

Senate Democratic Whip Dick Durbin of Illinois made exactly that point in comments to reporters Tuesday: “I’ve met with medical manufacturers in my state. And I think many of them are going to face some serious hardships when it comes to their competitive edge and research. But I’ve also told them quite frankly, ‘We’ve got to make up the revenue. If we’re going to walk away from any part ofthis revenue, we have to find another source.’”